Selective use of 3-D Secure

1. Introduction

To ensure PSD2 compliancy, we recommend not using these functions anymore.

The selective use of 3-D Secure feature was part of the now gradually deprecated 3DSv1. We originally introduced it to give you the possibility to handle exceptions and exemptions from 3-D Secure, ensuring high conversion rates for minimum risk transactions.

With the introduction of PSD2, the new 3-D Secure version 2 is available. This has replaced the original 3-D Secure. This new version define its own exemptions and exclusions from 3-D Secure. The selective use of 3-D Secure feature does not comply with these definitions.

To comply with PSD2 and to handle these exemptions/exclusions at the same time, we strongly recommend a different approach. Have a look at our dedicated 3-D Secure chapters for Hosted Payment Page/DirectLink to learn about it.

3-D Secure (also referred to as 3D secure authentication or 3DS) is a fraud prevention protocol that makes it possible to identify the cardholder by requesting online authentication. Unfortunately, 3DS may not just complicate the payment process for your customers but may also prevent valid and honest transactions from a successful completing at checkout.

Thankfully, you can use Selective use of 3-D Secure to:

- Combine with otherWorldline anti-fraud modules.

- Find the perfect balance between fraud protection and maintaining a smooth checkout experience for your customers.

- Deactivate 3-D Secure for low amounts transactions.

You will need an active Fraud Expert Scoring or Fraud Expert Checklist subscription to use this service. If you do not have a subscription, get in touch with an Worldline representative.

2. Before we begin

Selective use of 3-D Secure tool will need to be used in conjunction with one of the following Fraud Detection modules:

- CAP1 – Fraud Detection Module Advanced Checklist (FDMAc)

- CAP2 – Fraud Detection Module Advanced Scoring (FDMAs)

This guide will walk you through how to deactivate 3-D Secure (3DS) for transactions that are considered low risk by FDMAs or FDMAc.

To get started, make sure that your FDMAc or FDMAs subscription is activated. You can do this by going to Configuration > Account > Your options in your account. If it has not been activated, please get in touch with our support team.

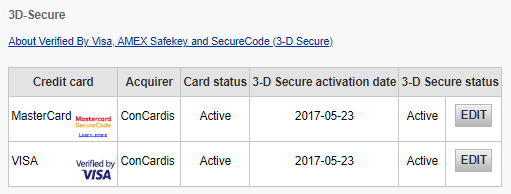

3. Manage 3DS settings

Once your fraud subscription is active, we can now configure your 3DS settings.

Go to Advanced > Fraud Detection. 3DS has to be configured individually for each payment method. Under 3-D Secure, select a payment method by clicking on EDIT. Any of these settings will overrule 3D-Secure preferences that you have configured with CAP1 or CAP2 (i.e. a Force Review rule will be ignored).

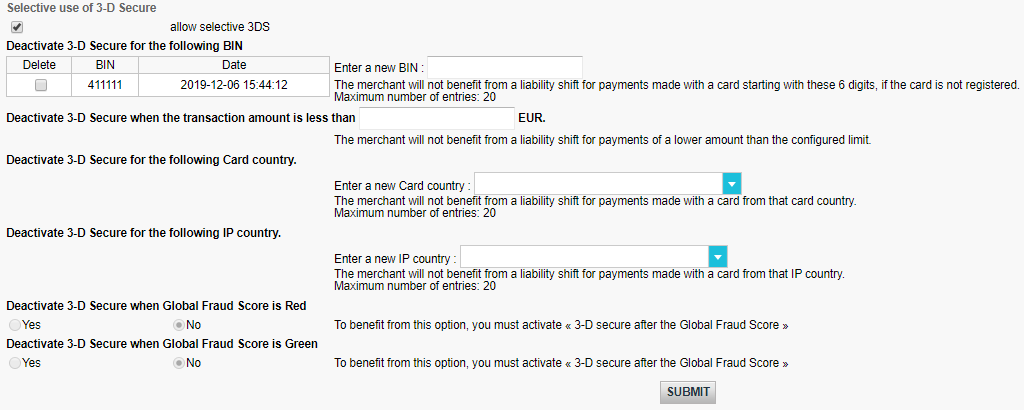

The table below provides you a guide on possible settings that you can configure.

| Description of settings | Explanation |

| Deactivate 3-D Secure for the following BIN | Enter the first six digits of a credit card |

| Deactivate 3-D Secure when the transaction amount is less than X EUR | If a transaction is below a specific amount 3DS will not be triggered |

| Deactivate 3-D Secure for the following Card country | Available only for Visa / MasterCard / American Express / Diners |

| Deactivate 3-D Secure for the following IP country | |

| Deactivate 3-D Secure when Global Fraud Score is Red | Available only if you are using Checklist or Scoring and Fraud Expert |

| Deactivate 3-D Secure when Global Fraud Score is Green | Available only if you are using Checklist or Scoring and Fraud Expert |

Add items by entering a specific value in the input fields or select an item from the dropdown menu. Remove items by flagging Delete. Confirm any of your actions by clicking on SUBMIT.

Note: By using these settings, you might not benefit from the conditional payment guarantee in case of chargebacks. Please contact your acquirer for more information.

If you have configured more than one setting, 3DS will be deactivated even if only one condition is met. Please get in touch with our fraud experts if you want to work with multiple conditions.